Corporate Fintech Monitor

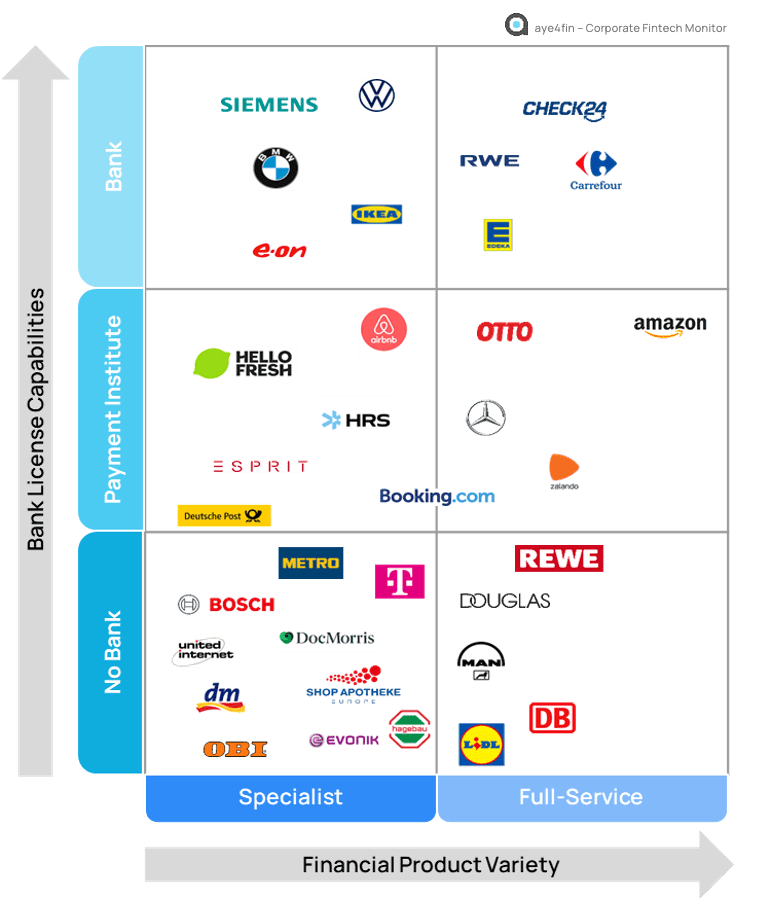

Based on several years of experience with retailers and marketplaces, aye4fin developed a methodology to help corporates understand the various setups on how digital payments can be provided to customers, the comparison with peer groups and possible target positionings.

Companies from different verticals, including retail, automotive and travel were researched and analyzed according to varying criteria. Some of these are: digital payment offerings, sourcing strategy, available bank licenses, innovation factor, payment relevance, internationalization, which serve to evaluate their product variety and bank license capabilities. The corporate fintech establishment within the observed companies was assessed as well as the objectives behind that process. All these findings are represented into this comprehensive map revealing the current landscape.

Would you like to read our Corporate Fintech Whitepaper?

Learn more about Corporate Fintech.

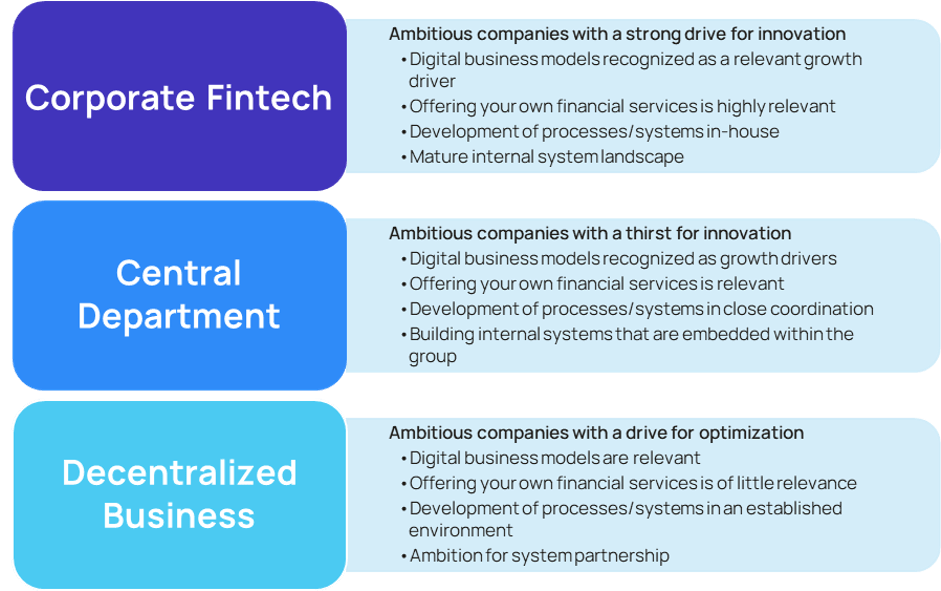

The setup of a Corporate Fintech makes sense, when companies need to bundle digital payments in their own independent subsidiary.

An increasing number of companies are continuing to expand their value chains.

But what are your options? Large companies focus on expanding financial services through dedicated departments or companies, applying one of the following approaches:

- building their own corporate fintech within the group,

- staffing a centralized fintech department, or

- using an external party for all their financial services.

Do you recognize your positioning according to the strategic relevance of building a corporate fintech for your company? We can help you identify the best approach following our proven methodology and build a corporate fintech of your own.