Why Payment Technology is the Bottleneck of Connected Cars

“Dear company, thanks for participating, but you are trailing behind six years.” That’s what established automakers are tired of hearing these days – and we are too, quite frankly.

But when tech portals like Nikkei Business Publications describe Tesla’s head start in manufacturing smart, connected cars, it’s better to be wide-awake. In between all the praise and bustle, there is one factor that’s key for Tesla’s success and can also be adopted by any other company: Developing and keeping the central control unit, including all essential building parts, in-house.

Therefore, the end-product (the car itself) is much less affected by the competition’s developments and the confusion that comes with a multitude of suppliers. Tesla can act independently, try out new features, climb its way to the top unimpededly. Now this approach, or let’s say “mindset”, can be applied to your business as well. And regarding future-oriented technologies like connected cars and digital payments, it is an especially valuable strategy. We will argue why – and show you the best-of-breed approach to implement it.

What Opportunities Connected Cars Offer

Let’s stay in the car for now. In 1886 Carl Benz patented his first “gas-powered vehicle”. Since then, not only car manufacturing and the car itself have changed, but also how we use it. The modern car needs to offer a holistic mobility concept, with in-car services, wallets, and payments being front and center of most innovations.

As of 2020, the market volume of these so-called connected cars has passed the 200 million Euro threshold. By 2030, it’s expected to grow to 530 billion Euros even. So, many companies – yours likely included – already invest in the research and development of smart cars and car-based payment systems.

But the devil is in the details. Let’s take one everyday use case for an example: Your car as your cart. Modern connected car applications could allow you to order your groceries while driving home. You stop by the store or at a parking spot, and the clerks will deliver your order right to the trunk of your car.

- Will you use long-range radio frequency identification (RFID) that sends payment data over the air?

- Will you embed Bluetooth low energy (BLE) hardware modules in the car that transmit data similar to the NFC (near-field communication) protocols currently used by most mobile payment apps?

- Will you entirely rely on third-party APIs and platforms, such as the Android Auto, recently released by Google?

- How to render a payment in or even by the car convenient and smooth for the car driver and the receiving party?

- Booking a parking spot before you even get there,

- Hands-free refueling at a gas station,

- Ordering food at a local restaurant,

- Booking repair services,

- Purchasing music, car computer UI designs, or the like,

- Voice shopping from any store anywhere in the world

- And then analyzing the purchase data of those applications for insights into your customers’ preferences.

All of the items on this list – and all others that we didn’t yet include – require a payment solution that’s in line with the requirements and can scale. Generic off-the-shelf payment technology does not, and most importantly, cannot support even these claims.

Custom Payment Solutions as an Innovation Driver

Car manufacturers face many challenges, and the market turns itself on its head every few years. So, if they do not keep their actual control unit (aka their payment solution) in-house, they are limited in the way they can innovate. As PSPs need to develop their products while also responding to external factors, such as regulatory changes, working with an external PSP means you can only react and not act productively. So, if the PSP changes its business practices or software, you as the manufacturer need to follow suit – whether you want it or not.

Additionally, the PSP aims to achieve the highest margin possible. Meaning, they want to attract and serve as many customers as possible, leading to mostly standardized payment products that are not designed to fit your unique business model.

As you can see, PSPs follow their own agenda. However, the customer is king. Your needs and goals should be center stage. To achieve this level of independence and self-sufficiency, you need to build up your payment processing in-house. Our partner trimplement has taken a closer look at developing the necessary payment technology in-house and has summarized the key benefits of a self-built solution for you here.

Payment-Orchestration for Connected Cars

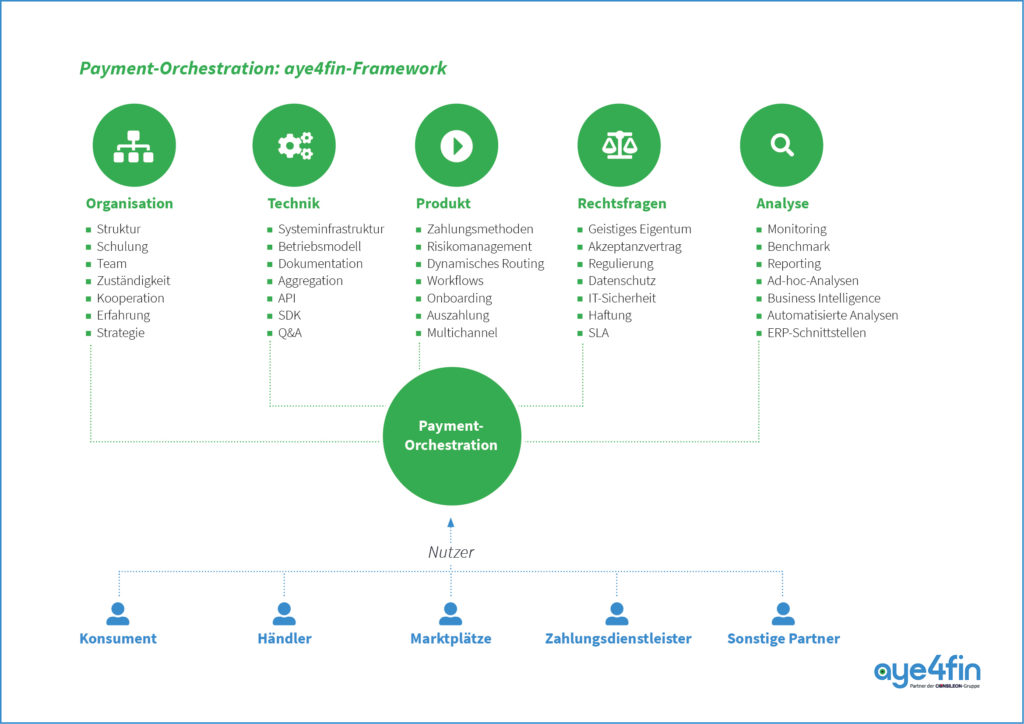

Payment-Orchestration (PO) is a holistic approach to payments, built upon five elementary pillars: organization, technology, product, regulation, and data analysis. Implementing PO opens up many opportunities for your business, among other things the following:

- You independently and flexibly select the best partners, payment providers, and payment methods that suit your business needs. Furthermore, Payment Orchestration enables you to expand globally by supporting you along the way.

- Leading innovation. Payment Orchestration allows you to focus on your core business while the complexity of payment processing has been semi-outsourced to your partners.

- Higher conversion. Your customers experience seamless and smooth payment processing through a diverse range of payment methods, compatibility with all devices, and optimized acquirer routing. Above-average cart abandonment becomes a thing of the past.

As with all approaches, Payment-Orchestration also comes with its own set of challenges:

- One-time high effort. That will pay off in the future, especially when it comes to business expansion and new use cases.

- Reliance on strong partners. While external expertise still plays an important role, you are the one to set the agenda.

Next Steps: Plan and Build Your Payment Solution

Standard off-the-shelf payment solutions will not get you very far. To be competitive, you must get into the driver’s seat to steer your business in the right direction. By all means, the idea of processing payments in-house is in no way revolutionary. In the retail industry, for example, self-made payment solutions are no rarity. Several large retailers, such as the OTTO Group, real.digital, or Zalando, have already implemented self-made payment solutions. However, a 100% in-house approach is also quite challenging and costly and therefore only recommended for those companies with annual revenue of above one billion Euros. Fortunately, Payment-Orchestration offers a middle ground.