5 aspects every FinTechs should consider when choosing a Banking as a Service solution

While FinTechs were merely ridiculed by established banks a few years ago, the situation has now changed significantly. Already in 2017, 88% of them feared suffering losses in their business from FinTechs (PwC, 2017).

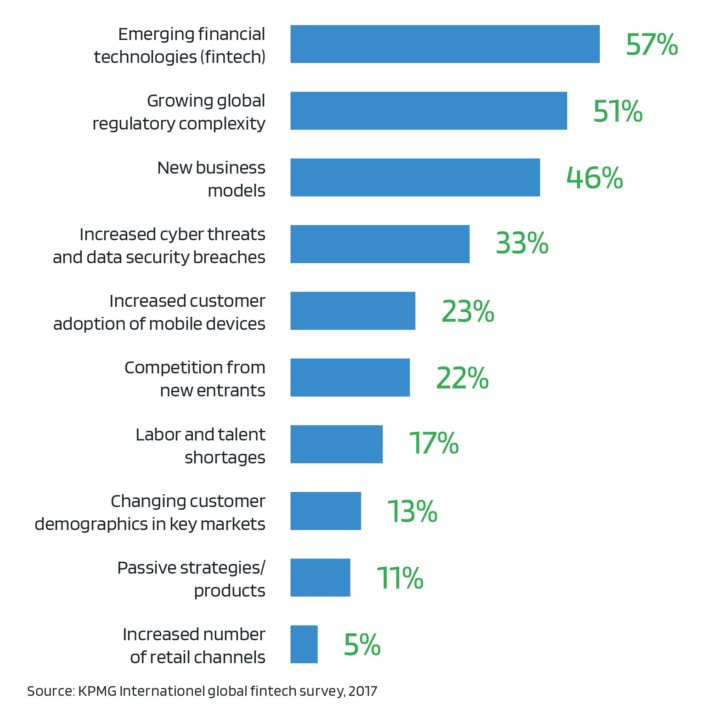

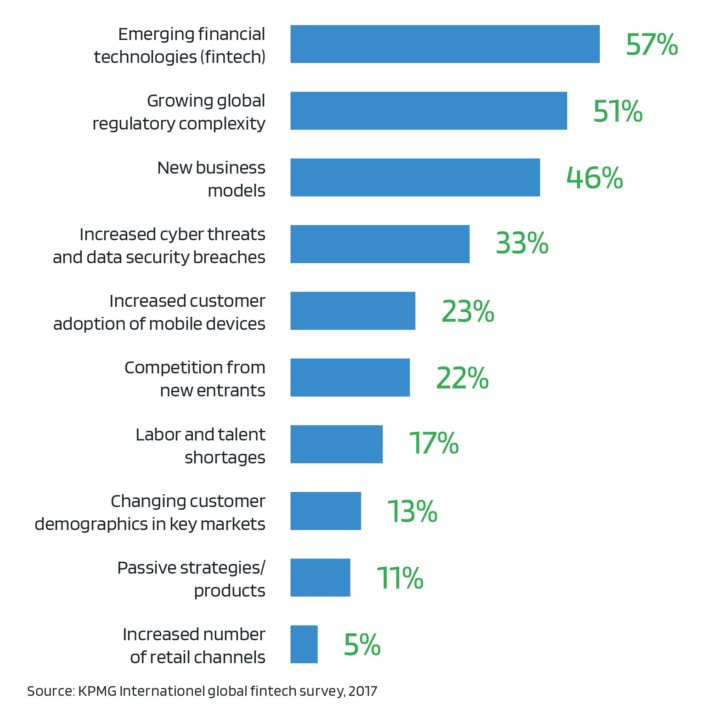

The term “FinTech” is misleading because the offers do not consist of pure technology for financial service providers but now consist of regulated financial services that compete directly with established banks. While 51% of banks see regulatory complexity as a major disruptive factor, FinTechs outsource these processes to suitable partners, so-called Banking as a Service (BaaS) providers, to focus on their strengths, such as technology and intuitive user guidance ( KPMG, 2017).

Should the business grow strongly, the outsourced services can be taken over again, as was the case, for example, with N26, which started with a solution from Wirecard. Of course, outsourcing can still be a permanent solution.

While BaaS service providers experienced an initial boom between 2012 and 2015, the market has cleaned up somewhat in recent years. Providers such as Fidor, net-m Privatbank, or Wirecard are no longer active for various reasons, while others have started a second wave and are now operating very successfully. The BaaS providers currently relevant for German FinTechs include:

1. Scope of Services

Although all providers use the same name, the scope of services can differ significantly. While providers such as Solarisbank provide an API-based solution integrated into technical infrastructure, other providers offer the contractual framework and payment processing using standard solutions such as EBICS.

2. Costs

This no-brainer sounds simple, but the cheapest provider is often not the one that is promising in the long term. Due to the regulatory requirements, five or six-digit setup fees are not uncommon. However, if the selected partner already supports similar business models, these costs can be significantly reduced. A distinction is often made between high monthly costs and high sales-related fees when it comes to running costs. Both models can be useful, but please be careful not to agree on any sales-related fees in a narrow-margin model that could tip your earnings model.

3. Implementation Time

Another exciting topic when choosing a BaaS provider is the implementation time, and yes, here too, there are the fast and the slow. Ask about the average implementation time for a similar project and then add 50%, and you are on the safe side. Unfortunately, there is another perspective, and this is related to the small number of providers and increasing demand. A number of providers currently have a full project list and cannot accept any new projects in the next three to six months.

4. Local IBANs

If you would like to expand internationally in the next 12 months, e.g., to Switzerland, France, or Italy, you should make sure to ask for local IBANs. Despite the uniform SEPA area, it is unfortunately still the case that French customers must pay high fees when transferring to an account with a German IBAN. This behavior and other requirements, such as a local account for payments to national tax offices, cannot be managed without local accounts.

5. Flexibility

Another vital point to consider is the flexibility of your BaaS provider. Often the fee model and most of the features fit. Nevertheless, the dealer onboarding process or technical integration does not meet the super solution’s requirements that you want to establish. Of course, there are the regulatory requirements that serve as a legal framework, but the interpretation of the framework conditions often decide on customer-friendly solutions.

The factors described are supposed to be complete in no way, but they certainly help in choosing the right BaaS provider that fits your business model.

The topic is more popular than ever – don’t let the competition overtake you!

aspects