Yet again! Request to Pay - Summit by Gini

The next attack on PayPal, Klarna & Co?

Since the first SEPA Request to Pay Scheme Rulebook was issued by the European Payments Council (EPC) at the end of 2020, it feels like little has happened. For people who only follow the payments world peripherally, the topic was initially nebulous and has actually remained so. However, in the third year after the first edition of the Initiation Scheme, you can at least hear a quiet rustling from the forest. Gini, a successful software provider for photo transfers, has set itself the goal of conquering the market with a SEPA Request to Pay solution.

At an invite-only event organized by Gini in Munich, selected top e-commerce companies such as Zalando, Amazon and Netflix as well as large banks such as Commerzbank, DZ-Bank and UniCredit were brought together to shed light on Request to Pay from all levels. aye4fin was also present at the event to incorporate relevant payment expertise from the consulting environment. To this end, we shared our insights from various projects, in particular what the payment mix looks like across different industries, what problems exist on the market and what success factors are involved in introducing a new payment process.

Since the first SEPA Request to Pay Scheme Rulebook was issued by the European Payments Council (EPC) at the end of 2020, it feels like little has happened. For people who only follow the payments world peripherally, the topic was initially nebulous and has actually remained so. However, in the third year after the first edition of the Initiation Scheme, you can at least hear a quiet rustling from the forest. Gini, a successful software provider for photo transfers, has set itself the goal of conquering the market with a SEPA Request to Pay solution.

At an invite-only event organized by Gini in Munich, selected top e-commerce companies such as Zalando, Amazon and Netflix as well as large banks such as Commerzbank, DZ-Bank and UniCredit were brought together to shed light on Request to Pay from all levels. aye4fin was also present at the event to incorporate relevant payment expertise from the consulting environment. To this end, we shared our insights from various projects, in particular what the payment mix looks like across different industries, what problems exist on the market and what success factors are involved in introducing a new payment process.

How does Request to Pay work again?

The basic principle of RTP is at least as old as the good old partially pre-filled remittance slip that (only rarely) arrives in your letterbox to pay an invoice. It is a request from a payee to the payer to send a certain amount.

This creates various advantages for the parties involved:

- End customers receive another flexible payment method to pay for purchases either immediately or with a special installment purchase offer from their bank

- Merchants can increase their conversion and save costs by reducing their dependence on major players such as PayPal or Klarna

- Banks, in turn, strengthen the relationship with their end customers and generate more traffic in their in-house banking apps with the opportunity to upsell or cross-sell

And Request to Pay in practice?

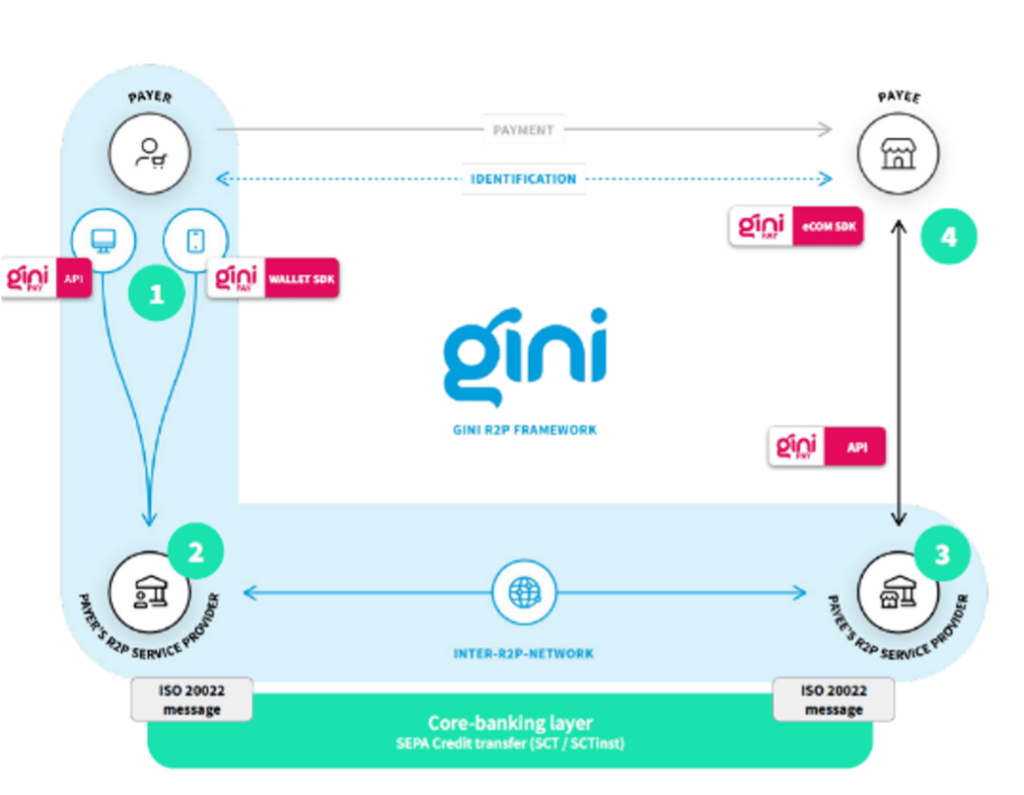

SRTP is by no means a new payment option, but rather the initiation of a payment transaction. The payment request is sent to the payer via the SRTP network (participating banks, PSPs and fintechs in the SEPA area that are certified by the EPC), for example via the banking app on the cell phone.

This is exactly where Gini’s RTP product comes in, which is why this process design was also an essential part of the event in Munich.

What's next?

At the evening get-together at the Gini office in a relaxed atmosphere, plans have already been made as to how the topic of RTP can best be turned into reality. To this end, Gini and aye4fin will continue to exchange ideas with interested merchants and banks in order to initiate a pilot in the near future.

Various use cases and the potential implementation of Request to Pay were discussed in joint interactive sessions. It was quickly agreed that RTP has sufficient innovation potential to be successful on the market. At the same time, however, it also became clear that banks in particular need to find joint solutions for the process chains that are still open, as they act as the primary mouthpiece to end customers and can therefore have a significant influence on the regular use of RTP.

Summit